Blog

Medicare Updates 2025: What you need to know

The new year is bringing notable updates to Medicare costs, especially for Parts B and D. Understanding these changes can help beneficiaries plan for potential increases in out-of-pocket expenses and prepare for shifts in income-related adjustments.

moreCelebrating Our Team’s Dedication to Making a Difference

At Stevens & Associates, we take immense pride in our team's dedication to supporting our clients. Each day, they go above and beyond to make a positive impact on people’s lives, ensuring clients feel informed, secure, and genuinely cared for in navigating their healthcare options.

moreDental with Medicare

Dental Coverage When You Have Medicare

Maintaining oral health is always important but becomes even more essential to our overall well-being later in life. Good dental health doesn’t just mean a beautiful smile — it’s key to staying healthy as we age. But, if you're on Medicare, you've likely realized that it doesn’t cover most routine dental services.

Here’s why having dental coverage matters even when you’re on Medicare and what options are available to ensure you’re not skipping out on essential oral care.

moreThe Perks of SilverSneakers and Gym Membership Programs in Medicare Plans: What You Should Know

As a Medicare beneficiary, you've likely come across enticing extras like SilverSneakers and other gym membership programs included in certain MediGap or Medicare Advantage plans. These perks can be a fantastic way to stay active and maintain a healthy lifestyle, but it’s essential to understand how these benefits fit into the broader picture of your healthcare coverage.

At Stevens & Associates, we believe it’s important to consider the value these programs offer without letting them become the primary reason for selecting a plan. Let’s break down the benefits and potential pitfalls.

The Benefits of SilverSneakers and Similar Programs

SilverSneakers, Renew Active, and other gym memberships can be a valuable part of your MediGap or Medicare Advantage plan. Here are some key benefits:

Physical Activity: Regular exercise can help improve your mobility, flexibility, and overall health. These programs make it easy by providing access to participating gyms and fitness centers.

Social Engagement: Many of these programs offer classes and group activities, helping you stay socially active, which is equally important for your mental well-being.

more

Back to School: Why Choosing the Right Health Insurance Plan Matters

As summer winds down and the new school year looms on the horizon, it's easy to get caught up in the flurry of back-to-school shopping, packing lunches, and organizing extracurricular activities. But amidst the hustle and bustle, one critical element often gets overlooked: ensuring you have the right health insurance coverage for your family. At Stevens & Associates, we believe that selecting the right health plan is crucial to supporting your child's health and academic success. Here’s why investing in the right insurance plan can make all the difference this school year.

1. Comprehensive Coverage for Preventive Care

The new school year is an ideal time to ensure your child is up-to-date with their annual check-ups, vaccinations, and screenings. Comprehensive health insurance plans cover these preventive services, which are essential for catching any potential health issues early. Investing in a plan that provides robust preventive care coverage ensures your child starts the school year healthy and ready to learn.

2. Access to a Network of Providers

Choosing a health insurance plan with a broad network of healthcare providers ensures you have access to quality care when you need it. Whether it’s for routine visits or unexpected emergencies, having a wide network can make it easier to find a provider that meets your family’s needs. Be sure to check the network directory of any plan you’re considering to ensure it includes your preferred pediatricians and specialists.

moreFall into your Health Insurance with us: Sign Up Now to Review Your Coverage Options for the Season

Fall marks the beginning of flu season. Ensure you’re up-to-date with your vaccinations can help protect you and your family. Do you have health insurance needs that haven't been addressed?

Sign up with us if you haven't already to review coverage options for the fall season this year. Prevent yourselves from getting sick and ensure you have the right coverage to support you and your family. We want to help keep your family safe and family during this fall and winter season.

Call or email us to make an appointment. One of our trusted advisors can reach out to your regarding coverage options for all of your needs. We specialize in Medicare, Covered CA, Private insurance, and other insurance products. We can also answer questions about Medical and Medicare. Make an appointment to see a representative in person or talk over the phone.

Cozy Up to a Coverage Review

As you enjoy the crisp autumn air and perhaps sip a warm pumpkin spice latte, take a moment to review your health insurance coverage. Just as you assess your fall wardrobe, it’s important to check if your plan still meets your needs. Are there any changes or new benefits for the coming year that you should consider?

moreMedicare Advantage vs Medicare Supplement

Navigating the world of Medicare can be overwhelming for seniors, with a myriad of plans and options available. Choosing the right health insurance is crucial for ensuring comprehensive coverage and peace of mind. This guide aims to simplify the process by exploring the best health insurance options for seniors on Medicare.

more2025 Medicare Part D Changes: What You Need to Know

2025 Medicare Part D Changes: What You Need to Know

As we approach 2025, it's important to stay informed about the changes coming to Medicare Part D. Especially this year as this may perhaps be one of the biggest changes in the history of Medicare Part D. Here is a breakdown of the key changes you can expect and how they might impact your prescription drug coverage.

1. Introduction of a $2,000 Out-of-Pocket Cap

One of the most significant changes in 2025 is the introduction of a $2,000 out-of-pocket cap for prescription drugs under Medicare Part D. This is a monumental shift, as it provides a financial safety net for beneficiaries who previously faced potentially unlimited costs for their medications. Once you hit the $2,000 threshold, all covered medications should be reduced to $0 for the remainder of the year. This change is expected to provide substantial relief for those with high medication expenses.

2. Elimination of the Coverage Gap (“Donut Hole”)

The “donut hole” has been a source of confusion and financial strain for many Medicare beneficiaries. In 2025, the coverage gap will be completely eliminated. This means that beneficiaries will no longer experience a temporary limit on what the drug plan will cover for prescription drugs. Instead, after meeting the deductible, you'll pay a consistent copay or percentage of your drug costs until you reach the new out-of-pocket cap.

moreWays to Be Your Olympic Athlete: Infusing Fitness and Health into Your Routine

The Summer Olympics are always inspiring, showcasing the pinnacle of athletic achievement and dedication. Watching these incredible athletes can motivate us to integrate more fitness and health-oriented activities into our lives. Here are some great ways to channel your inner Olympian and make fitness a fun, regular part of your routine:

1). Visit a Farmer's Market

Farmers markets offer locally sourced produce, and organic options, and are a great way to be involved in your local community. Check out this link for your local farmers market: Find Your Local Farmers Market.

2). Biking

Cycling can be a great way to get around and is an excellent cardiovascular workout. It strengthens your legs, improves joint mobility, and boosts your fitness. Consider biking to work, the store, or just for fun!

3). Walking 30 Minutes a Day

Walking just 30 minutes a day can burn calories, strengthen bones, and lift your mood. Try to incorporate a brisk walk into your daily routine.

4). Hiking

moreUnderstanding Alzheimer's Care and Medicare Coverage

Alzheimer's disease, the most prevalent form of dementia, stands as the fifth leading cause of death among Americans aged 65 and older, according to the Alzheimer's Association. This progressive condition not only affects cognitive abilities but also poses significant financial challenges for families navigating care options.

Medicare Coverage for Alzheimer's Care

Medicare, the federal health insurance program primarily for seniors, provides coverage for certain essential care costs related to Alzheimer's disease. For individuals aged 65 or older diagnosed with Alzheimer's or dementia, Medicare covers:

· Inpatient Hospital Care: Necessary for managing acute medical needs related to Alzheimer’s.

· Doctor’s Fees: Partial coverage under Medicare Part B ensures access to crucial medical services.

· Prescription Drugs: Many medications are covered under Medicare Part D, including those prescribed for Alzheimer’s.

· Skilled Nursing Home Care: Medicare includes up to 100 days of skilled nursing care under specific conditions.

moreIs Ozempic Covered by Medicare?

In 2021, Medicare spent $2.6 billion on Ozempic, making it one of the top 10 drugs that Medicare spends the most on (AARP).

What is Ozempic?

Ozempic, known as semaglutide, is purposed to control blood sugar levels with type 2 diabetes. It is injectable and has weight loss effects due to the activation of insulin. It is Food and Drug Administration (FDA) approved for those with type 2 diabetes, but not weight loss.

Eligibility and Pricing:

According to Good Rx, an American Healthcare Company that tracks prescription drug prices, 93% of Medicare prescription drug plans cover Ozempic under the condition that those eligible have type 2 diabetes.3

(The payments for the drug cost will vary based on the plan)

4 Without qualifying for type 2 diabetes, costs for this drug can vary from $900-1,100. (good rx).

There are restrictions even for those who qualify, including having limits on quantity for a refill, and those candidates must seek prior authorization from their prescriber before they start the drug.

Controversy with Ozempic:

According to the Centers for Disease Control and Prevention (CDC), over 40% of U.S. adults are medically obese in the United States. Many have flocked to the drug for results as a substitute for diet or going to the gym (CDC).

moreThe Future of Medicare Advantage and Fair Competition

Medicare Advantage has been rising in popularity in recent years. According to the Centers for Medicare & Medicaid Services, in 2024, 33.8 million enrollees constitute Medicare Advantage. Medicare Advantage has taken more than half a share of the Medicare Marketplace, making up for over 50% of Medicare plans. The May Congressional Budget Office (CBO) estimates that the plans will make up 62% of all Medicare plans in 2033.

It comes as no surprise that big healthcare providers such as UnitedHealthcare and Humana have seen tremendous growth in beneficiaries that use these types of plans nationwide.

However, there are many questions concerning whether the current benefits will continue in the future with the growing demand from consumers and providers valuing their profit margins.

Wall Street Journal recently published the article "Your Medicare Plan Might Not Include as Many Freebies Next Year", which focused on the possibility of benefits being cut from these plans. Providers may be incentivized to cut back on certain benefits, including gym memberships or dental, that are a part of most Medicare Advantage plans.

CMS has assured that in 2024 Medicare Advantage and Medicare Prescription Drug Programs will remain stable. But what initiatives are they taking to do so?

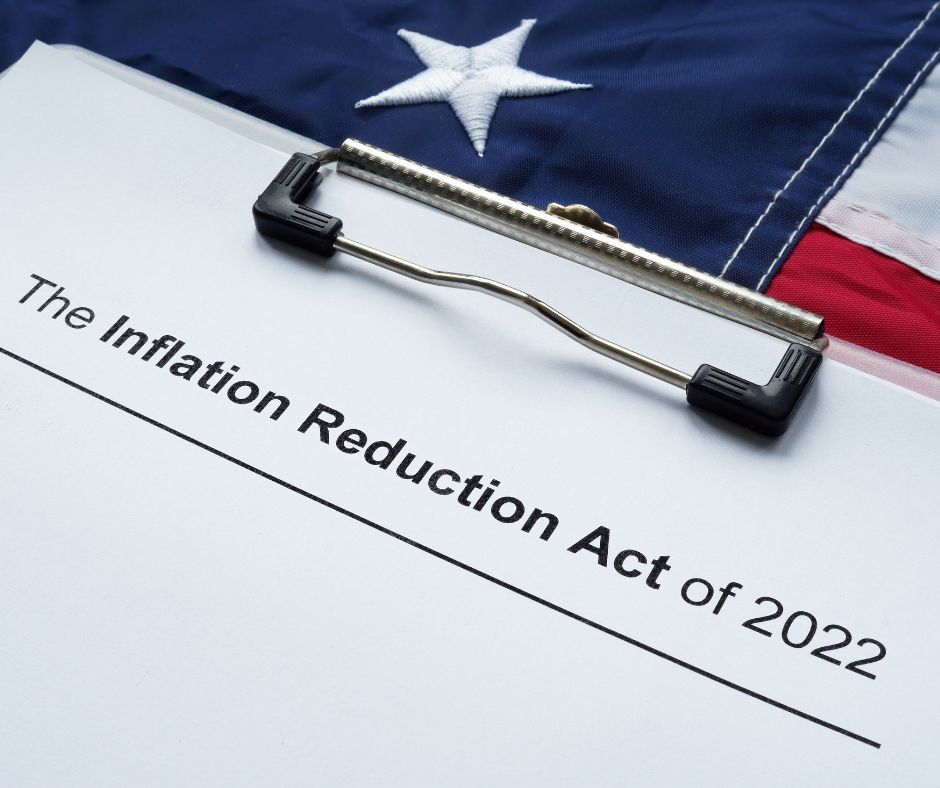

moreThe Impact of the Inflation Reduction Act: Unveiling Changes for 2024 and 2025

Introduction:

The healthcare landscape is constantly evolving, and 2024 marks a significant milestone in the transformation of Medicare Part D in response to the Inflation Reduction Act of 2022. This act, lowered drug costs and reduced federal spending, allowing accessible and cost-effective healthcare experiences for millions of Americans.

Changes for 2024:

One of the most notable changes coming in 2024 is the costs associated with the catastrophic phase in Medicare Part D. Enrollees without low-income subsidies, facing high spending, will now benefit from a capped limit. In 2024, this cap is set at $8,000, covering both out-of-pocket expenses and the value of the manufacturer price discount on brand-name drugs in the coverage gap phase. Part D enrollees taking brand-name drugs in 2024 will only spend $3,300 out of their own pockets, eliminating additional costs for their medications. This is a tremendous shift from the potential out-of-pocket costs ranging between $11,000 to $15,000 in 2023. For example, the popular drug Pomalyst, which cost $11,800 in 2023, will see a drastic reduction to $3,300 in 2024.

The Impact on Drug Manufacturers:

moreRecent Changes in Medi-Cal Eligibility: Breaking Down the New Legislation

In the evolving landscape of healthcare policies, particularly in California, there have been significant recent changes in Medi-Cal eligibility, in regards to immigration status. These changes aim to enhance accessibility and inclusivity in healthcare, ensuring that a wider demographic can benefit from the benefits of full-scope Medi-Cal coverage.

According to Covered California, under the Affordable Care Act, most immigrants qualify for health coverage, including green card holders, temporary residents, refugees, those with temporary protected status, and working or student visas. These new laws present an opportunity for both lawfully and unlawfully present individuals who apply through Covered California for eligibility for a health plan.

One noteworthy development is the implementation of the Older Adult Expansion, a law that took effect in May 2022. This law is a stride towards healthcare equality, as it now grants full-scope Medi-Cal for adults aged 50 or older, regardless of their immigration status. While this expansion broadens the coverage, it's important to note that all other traditional Medi-Cal eligibility rules still apply.

The young adult population has also seen positive changes in their healthcare coverage. The Young Adult Expansion program, applicable to individuals under the age of 25, operates under the same rules and regulations as the Older Adult Expansion.

moreHealthy Ways to Stay motivated for 2024

2024 is here, and it is time for you to get out of life what you deserve. There are many ways to stay motivated to achieve your goals. Health plays a pivotal role in motivation and is a driving force in all areas of life. Here are some healthy ways to stay motivated for 2024!

Practice Positivity and Gratitude

1). Psychologists have indicated that expressing gratitude regularly can improve your quality of sleep and reduce feelings and anxiety and depression.

2). Using positive language correlates to better moods and less fatigue and inflammation.

Create a routine

1). Create daily tasks that focus on your health and that are repeatable. Brushing your teeth, showering, shaving, or getting ready for the following day of work are good daily practices that can be a part of your routine.

2). Take 10 minutes to meditate and take time for yourself.

Self-Care

1). Try to get enough sleep daily. The CDC recommends 7-8 hours for adults 65+.

2). Spend 30 minutes a day doing moderate physical activity. Take a walk to your local park or go on a short hike.

3). Develop a fitness routine for your needs.

moreNavigating Medicare Advantage Plans and Hospital Rejections

According to the Centers for Medicare & Medicaid Services, Medicare Advantage is a type of Medicare Health Plan "offered by Medicare-approved private companies that must follow rules set by Medicare." Most Medicare Advantage Plans include drug coverage (Part D). Https://www.medpagetoday.com/ states that more than half of all Medicare Beneficiaries are enrolled in Medicare Advantage.

Recently, hospitals have been rejecting Medicare Advantage plans because the carriers who offer these coverages are providing inadequate payments that don't cover the cost of patient care.

Medical facilities, including Scripps' Health, which is one of San Diego's top Medical Centers' have experienced a loss of $75 million this year solely on the Medical Advantage contracts. In late September of 2023, Scripps announced that they were terminating Medicare Advantage contracts, as reported by Becker's Hospital Review, which would affect more than 30,000 estimated seniors regionally; doctors from Scripps Clinic and Scripps Coastal will still accept Original Medicare (Part A and Part B). Doctors who are part of an independent medical group affiliated with Scripps can still allow their Medicare Advantage patients to receive care.

moreMedicare Deductibles and Premium Costs for 2024

On October 12th, 2023 the Centers for Medicare & Medicaid Services (CMS) announced the 2024 deductibles and premium amounts for the Medicare Part A and B Programs. As well as the 2024 Medicare Part D income-related monthly adjustment amounts.

Due to recent inflation, The Inflation Reduction Act has increased the eligibility of access to lower-cost prescription drugs.

Part A

The Medicare Part A inpatient hospital deductible that beneficiaries pay if admitted will be $1,632 in 2024, a $23 increase from 2023.

The Part A inpatient hospital deductible covers beneficiaries' share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

Part B

Medicare Part B covers doctors' services and tests, outpatient care, home health services, durable medical equipment, and other medical services that are not covered by Part A.

The standard monthly premium for Medicare Part B enrollees will be $174.70 for 2024, which is a $9.80 increase from 2023.

The annual deductible for all Medicare Part B beneficiaries will be $240 in 2024, a $14 increase from the prior year.

CMS indicated that the price increases are due to healthcare spending and to a degree, the remedy for the 340B-acquired drug payment policy for the 2018-2022 period.

moreArtificial Intelligence (A.I.) Growing Immergence in Medicare

A.I. has become a pivotal aid for daily life. We use A.I. when talking to Siri, Amazon’s Alexa, or chat GPT to gain recommendations on what to write about a topic or event. This technology is changing the digital landscape by automating the processes of ad targeting, lead generation, SEO and evaluating/ organizing complex data. Although, these automations can be helpful, especially for healthcare professionals, they must be regulated and monitored closely for optimal efficiency and efficacy.

Several A.I. tools assist in Medicare procedures, including automated data management, streamlining patient records and administrative tasks, and reducing errors to ensure data accuracy.

A tool utilized by multiple websites and facilitated customer service is Chatbots. They use their AI and machine learning capabilities to answer basic questions and fulfill orders online. They help consumers navigate a company’s webpage and provide engagement, especially towards Seniors. Bots are different than live chat software because they respond on their own automated responses and are customizable to handle varying conversations. Even though these chatbots are emerging, many consumers prefer to talk to an individual rather than a robot or A.I. It is essential to engage consumer’s different needs and preferences.

moreKey Takeaways from HSA contributions in 2023 and 2024 (what to expect)

To be HSA eligible, one must be enrolled in an HSA-Eligible Health Plan, not enrolled in Medicare, not claimed as a dependent and make contributions to that plan.

There are significant changes to HSA contributions in the year 2023 -2024. A single policy plan can cover up to $3,850 in 2023, and a family plan reaches up to $7,750, a staggering $400 increase from 2022. Individuals 55 or older can contribute $1,000 annually. There is an even higher increase in 2024, which will cover $4,150 for self-coverage ($300 increase), and $8,300 for family ($550 increase). There are considerable policies to take advantage of, even more advantageous than previous years.

Inflation has been a primary cause for the increase in HSA contributions from 2022-2024. Although inflation is trending downward, there is a (7-8%) increase from last year. The inflation was a response to the shift from services to goods, issues with supply chains, the shifts in the demand for housing and Russia’s Invasion of Ukraine, which dramatically increased the price of oil.

Thus far, the average account holder contributes far less than the max contribution. Now would be an ideal time to take advantage of the HSAs contributions and build a nest egg for future Medical Expenses, which can significantly impact retirement.

moreTry this Pumpkin Spice Recipe for Fall (easy to make)

As fall approaches and the Holidays come into swing, it’s a terrific time to spend cooking with family and friends. What better way to celebrate with family and friends than with an amazing beginner-friendly organic Pumpkin Spice Recipe? This wholesome dish will not only taste great but is a nutritious substitute for desserts that are higher in sugar and calories. Get ready to embrace the joys of autumn with this delicious recipe.

Ingredients:

Flours:

· ½ cup of all-purpose flour and ½ cup whole wheat flour

Spices:

· 2 Teaspoons ground cinnamon

· ¼ teaspoons ground nutmeg

· ¼ teaspoon ground ginger

Salt:

· ½ teaspoon salt

Eggs:

· 2 Eggs

Baking Powder & Baking Soda

· ½ teaspoon baking soda

· ½ teaspoon baking powder

Brown Sugar

· 2/3 cup of brown sugar

Pumpkin

· 1 cup of pumpkin puree

Milk

· ¼ cup of milk (dairy or substitute)

moreHealthy Dessert Ideas for Fall

Fall is approaching.

As the weather becomes colder, the Holidays are near, and family gatherings ensue, desserts become a popular commodity.

Although pumpkin pie, chocolate cake, and cookies are delicious treats, they can be very high in calories.

The Dietary Guidelines for Americans stated to limit added sugars and saturated fats to less than 10% of calories per day.

Calories are a crucial factor when making meals. When the number of calories you consume matches the number of calories you burn, your weight remains stable. A caloric surplus or deficit will dictate weight loss or gain.

Fortunately, some alternatives be just as tasty with lower calories.

Healthy options include:

- Yogurt and Berries

- Frozen Fruit Bars

- Dark Chocolate

- Frozen Grapes

- Baked Apples

- Dole Whip

- Grilled Pineapple

- Fruit and Cheese

Try any of these ideas and see what you think!

moreWhat Is Medicare Supplement Insurance?

As we grow older, our health becomes even more important. With the rising costs of medical care, it’s essential to have the right insurance coverage to protect your health and finances. That’s where supplemental health insurance comes in, specifically Santa Barbara Supplemental Plans, also known as Medi Gap. Stevens & Associates Insurance Agency wants to help you understand Medicare Supplemental Insurance, so today, we’ll go over what it is and how it can help you.

moreThe Benefits of Working with an Insurance Agency

When you’re working to find insurance coverage for yourself and your family, you have a wide range of options to choose from. Whether you’re used to working directly with large insurance providers or you’re experienced in working with an insurance agency, Stevens & Associates Insurance Agency is your top choice for finding great coverage options! Here are four benefits our clients enjoy when they work with us.

moreWhat Is Medicare Part A and Part B?

Medicare is a federal health insurance program that insures individuals over the age of 65. It is also available to certain individuals who are under the age of 65 and meet other qualifications. However, it is important to understand there are different parts to Medicare plans that you should be aware of.

At Stevens & Associates Insurance Agency, Inc., we want to make sure our customers in Santa Barbara, CA, understand how Medicare insures individuals and the differences between Part A and Part B. Keep reading to get more information!

moreA Look Into Our Products

At Stevens and Associates Insurance Agency, Inc, we care about each individual we work with, and if you need assistance with your insurance options, you can turn to us to provide what you need. Read below to learn a bit more about our policies and other programs. We are committed to our customers, and we work tirelessly to ensure you are taken care of. Contact us today!

moreWhat Is Medicare Part D?

Welcome to Stevens and Associates Insurance Agency, Inc! As a full concierge insurance ageny, you can trust us to handle your health insurance needs, and we have more than 65 years of experience for your peace of mind. This blog explores what you should know about Medicare Plan D, and we encourage you to read below to learn more about your options. Contact us today!

moreWelcome

Welcome to our site! We are in the process of building our blog page and will have many interesting articles to share in the coming months. Please stay tuned to this page for information to come. And if you have any questions about our business or want to reach out to us, we would love for you to stop by our contact page.

Thank you!

more